This is my story.

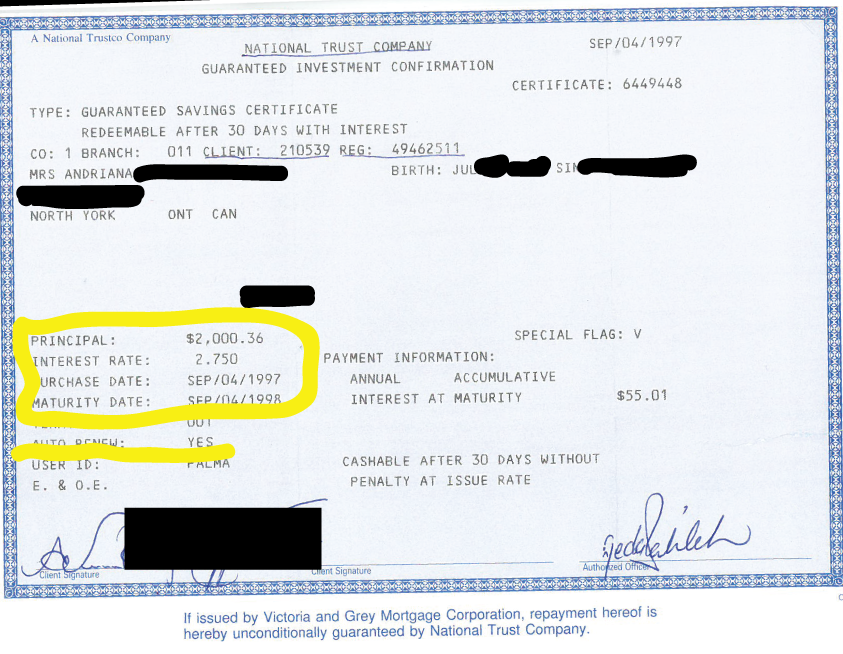

To say that I am disappointed is an understatement. I am a mother of twin girls. As I am getting older I decided to get my affairs in order and document everything at theRIPregistry.com. I went to my safety deposit box and found a National Trust Company GIC which was purchase on September 4, 1997. It was supposed to have auto renewed annually. The GIC certificate ($2000.36 at 2.75%) along with bonds purchased were placed in a Safety Deposit box for safe keeping and to be redeemed when the time came. The plan was to put money aside in order to grow and eventually be used towards their education towards university cost. Today 2018, my kids are older and both are in university. I contacted Scotia Bank who acquired (bought-out) National Trust back in August 1997. Scotia (office of the president) apologized and said “this GIC was too old” they further told me they keep their records for only 7 years under the government rules and that they found nothing and there was nothing they can do”.

Their research of my GIC renewal certificate included checking the Bank of Canada to see if it was transferred over to them. This GIC was purchased after they announce the acquisition of National Trust and now they seem to be pointing the finger everywhere else. It is important to note that the Bank of Canada only accepts funds from accounts that had been dormant and unclaimed (this would be savings and chequing accounts). What I purchased was a GIC and had it set for auto renew, therefore the chances of it becoming dormant was NIL. To insult me stating they checked the Bank of Canada to see if it was in their hands was disappointing and to further blame their client (me) stating that it had to have been cashed is distasteful.

The GIC certificate has my birth date, my SIN and had my sister’s home address. Life moved on and I ended up in the hospital several times. My kids being 2 months premature were in and out of the hospital and life was hectic with the girls. Therefore to say that I at some point cashed in this GIC investment which was set for auto renew is absurd. $2000.36 amounts to quite a bit of money after 20 years of renewing at the higher interest rate.

If The RIP Registry (theRIPregistry.com) was available 20 years ago, I don’t believe this GIC would have been lost. The RIP Registry is an on-line tool that would be visited frequently as life goes on when deciding to purchase, life insurance or disability insurance. It is useful to document your vehicle, home and land purchases, business ventures, partners, loans given or borrowed. You may have purchased life or disability insurances or antiques, jewellery, storage units etc. What if along the way, as many of us have, decided to purchase RESPs (Educational Savings Plans) maximizing the government grants for your children. With The RIP Registry (theRIPregistry.com) you would be able to document your progress and built up products in your portfolio at theRIPregistry.com easily and at no cost (Abolutely Free). Its accessible anywhere any time.

Looking back at what I lost & forgotten, I can honestly say that you have to take care of your own destiny and finances by visiting your investments, mortgages, products etc. annually and keeping it fresh in your mind. Trusting the Banks, your investors or insurance companies, in my opinion, is not the way to go. They all say they have your best interest at heart and are working for you, but are they? It’s all about money and what you can do for them. Remember no one will take care of YOU or what you have worked so hard for, like YOU will. In case of floods, fires or you just can’t remember where you have what and where, The RIP Registry is an online tool that can help, it’s SECURE and it’s FREE!, Sign up at theRIPregistry.com.

Recent Comments